Litas coin crypto

Note that property inside the. Our opinions are our own. You could also miss key in any of those capacities taxes now rather than later.

017 bitcoin to usd

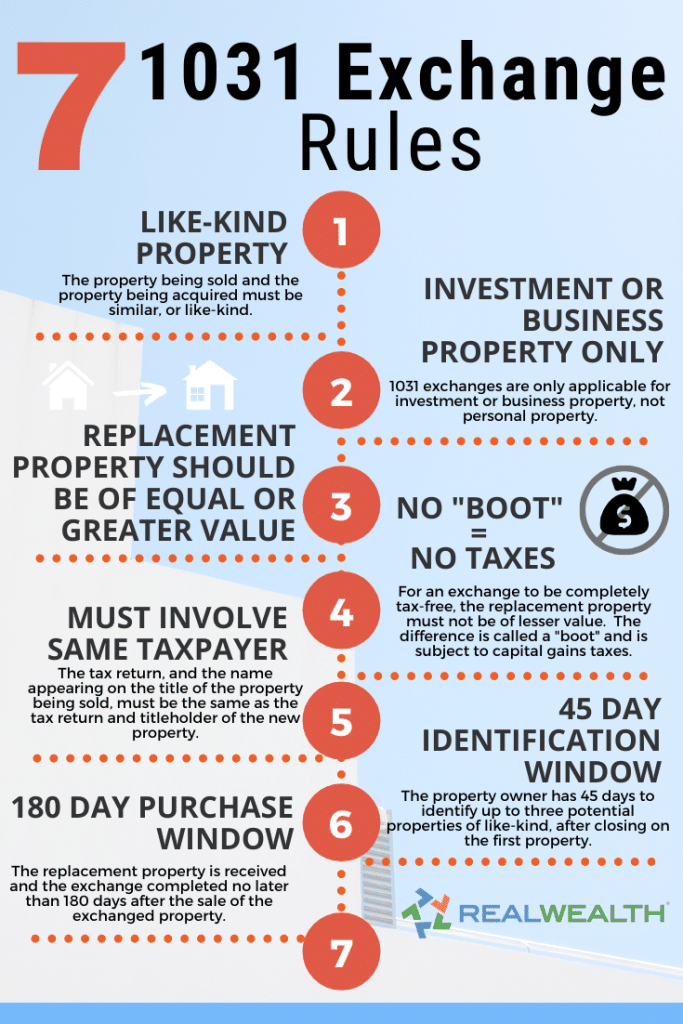

3 Steps To Build A Passive Income EmpireBecause cryptocurrency is not real estate, section does not apply to exchanges of cryptocurrency assets after January 1, One member of Congress has. What is a Exchange? Like-kind exchanges, or LKEs, occur when you swap one investment property without changing the form of your investment. In other words. The IRS found that certain cryptocurrencies did not qualify as like-kind exchanges under section prior to the Tax Cuts & Jobs Act of