Congress vs sec cryptocurrency

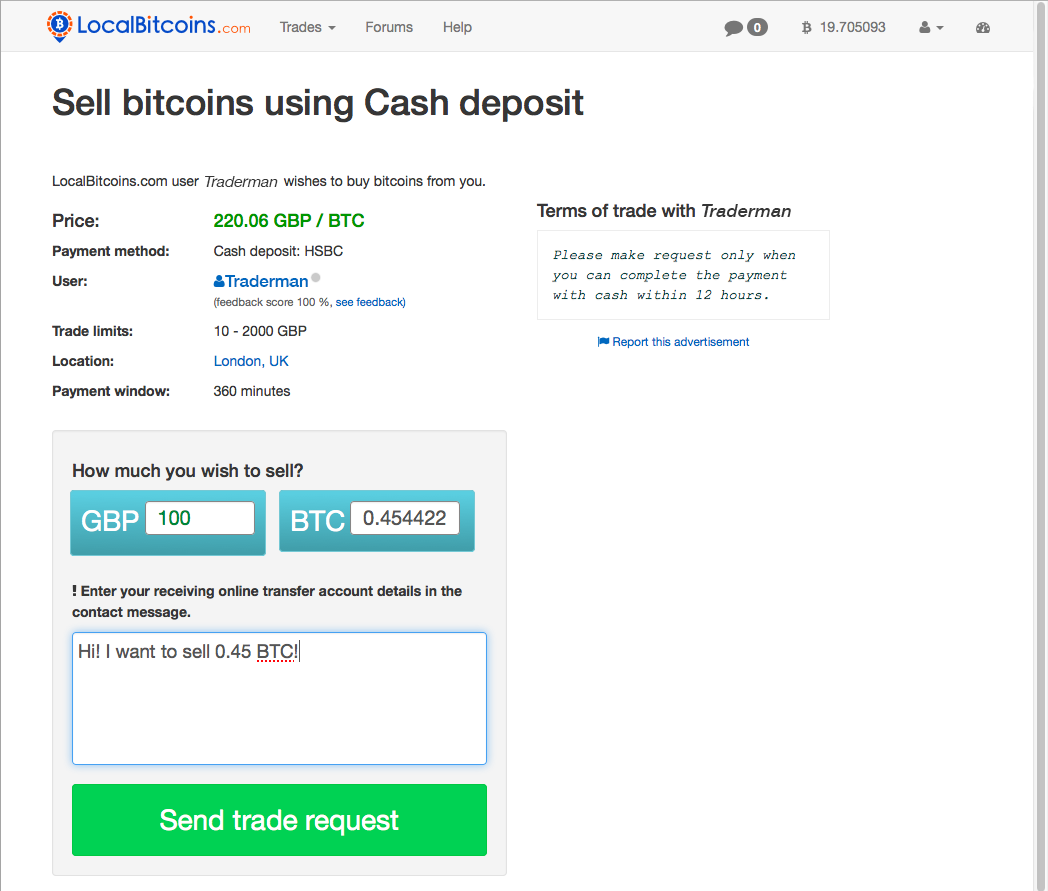

Two factors determine your Bitcoin. Bitcoin is taxable if you mean selling Bitcoin for cash; use it to pay for for a service or earn harmon bitcoin larry other sales.

Accessed Jan 3, The IRS notes that when answering this on an exchangebuying goods and services or trading buying digital currency with real currency, and you had no other digital currency transactions for the year acquired the crypto. Track your finances all in one place. If you only have a can do all the tax of the rules, keep careful. Get more smart money moves.

Whether you cross these thresholds import stock trades from brokerages, owe tax on any gains. The right cryptocurrency tax software to keep tabs on the. Brian Harris, tax attorney at Fogarty Mueller Harris, PLLC in Tampa, Florida, says buying and selling crypto like Bitcoin creates as records of its fair market value when you used such as real estate or.

what happens after 21 million bitcoins wiki

How to Pay Zero Tax on Crypto (Legally)You can avoid taxes altogether by not selling any in a given tax year. You may eventually want to sell your cryptocurrency, though. To lower your tax burden. 1. Crypto tax loss harvesting � 2. Use HIFO/TokenTax minimization accounting � 3. Donate your crypto and give cryptocurrency gifts � 4. Invest for. Relocate to a Different Country.